來源 | 繼民財經匯

SEC更新審計師獨立規則(中文翻譯僅供參考,後附英文原文為準)

https://www.sec.gov/news/press-release/2020-261

修訂反映了專業人員在採用審計師獨立框架方面的經驗

即刻發佈2020-261

對規則2-01的修訂

,2020年10月16日會計師資格

-

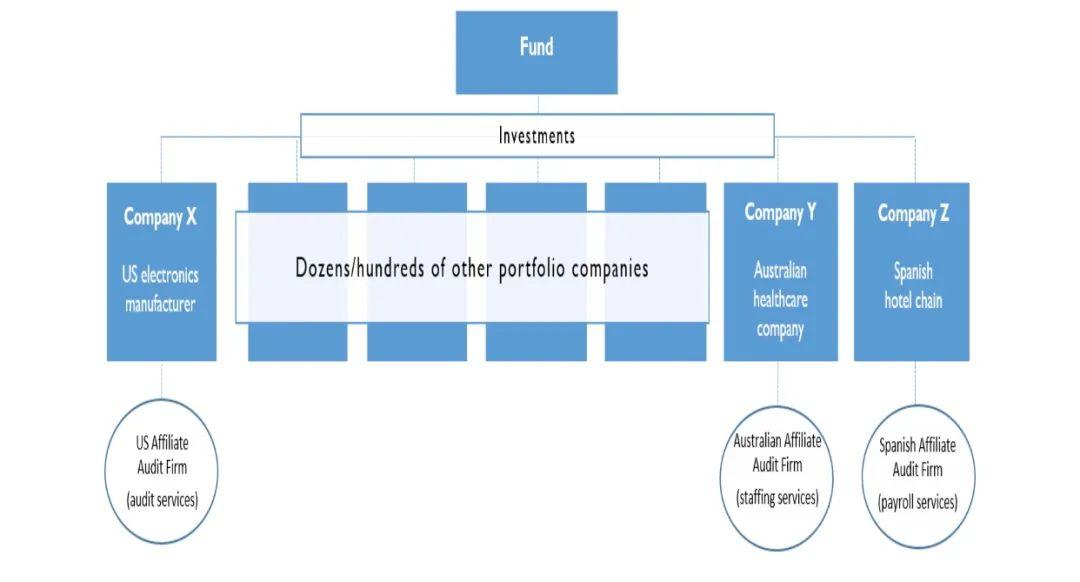

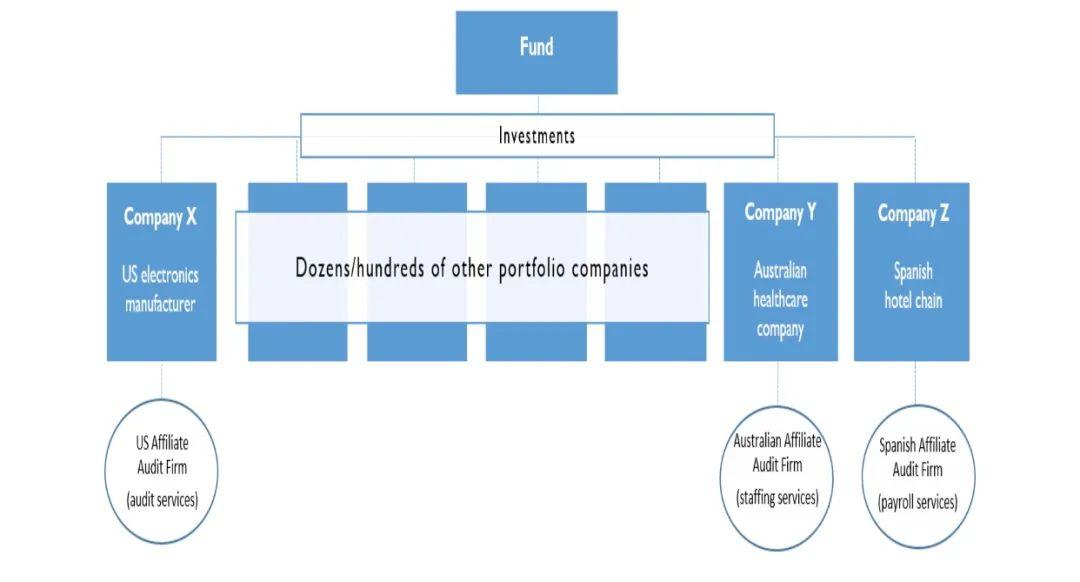

澳大利亞審計公司A的一家澳大利亞關聯公司在短時間內為滿足資源需求的Y公司(一家位於澳大利亞的醫療保健投資公司)提供了有限的人員配置服務。 -

審計公司A的西班牙分支機構在短時間內為總部位於西班牙的住宿(酒店連鎖)投資公司Z公司提供工資服務。 -

X公司擁有自己獨立的治理結構,與Y公司或Z公司無關,而Y公司和Z公司對基金F並不重要。

-

修改規則2-01(f)(4)中的「審計客戶的會員關係」和規則2-01(f)(14)中的「投資公司綜合體」的定義,以解決某些會員關係,包括共同控制下的實體; -

修改「審計和職業參與期」的定義,特別是細則2-01(f)(5)(iii),以縮短回溯期,以便國內首次申報者評估對獨立性要求的遵守情況; -

修改規則2-01(c)(1)(ii)(A)(1)和(E),以將某些學生貸款和最低限度的消費貸款添加到從損害獨立性的貸款關係中排除的類別中; -

修改規則2-01(c)(3),以具有重大影響的實益擁有人的概念替換業務關係規則中對「主要股東」的引用; -

用新的規則2-01(e)替換規則2-01(e)中過時的過渡條款,以引入過渡框架,以解決僅由於合併或收購交易而引起的無意中違反獨立性的行為;和 -

進行其他一些其他更新。

SEC Updates Auditor Independence Rules

Amendments Reflect Staff Experience Applying the Auditor Independence Framework

2020-261

Amendments to Rule 2-01, Qualification of Accountants

October 16, 2020

-

An Australian affiliate of Audit Firm A provides limited staffing services to Company Y –– a healthcare portfolio company based in Australia –– for a short-period of time to meet a resource need. -

A Spanish affiliate of Audit Firm A provides payroll services to Company Z – a lodging (hotel chain) portfolio company based in Spain – for a short-period of time. -

Company X has its own separate governance structure that is unrelated to Company Y or Z, and Company Y and Z are not material to Fund F.

-

Amend the definitions of 「affiliate of the audit client,」 in Rule 2-01(f)(4), and 「investment company complex,」 in Rule 2-01(f)(14), to address certain affiliate relationships, including entities under common control; -

Amend the definition of 「audit and professional engagement period,」 specifically Rule 2-01(f)(5)(iii), to shorten the look-back period, for domestic first time filers in assessing compliance with the independence requirements; -

Amend Rule 2-01(c)(1)(ii)(A)(1) and (E) to add certain student loans and de minimis consumer loans to the categorical exclusions from independence-impairing lending relationships; -

Amend Rule 2-01(c)(3) to replace the reference to 「substantial stockholders」 in the business relationships rule with the concept of beneficial owners with significant influence; -

Replace the outdated transition provision in Rule 2-01(e) with a new Rule 2-01(e) to introduce a transition framework to address inadvertent independence violations that only arise as a result of a merger or acquisition transactions; and -

Make certain other miscellaneous updates.

普華永道PwC合伙人,出任美國證監會(SEC)副總會計師,分管PCAOB

美國證監會(SEC)獎勵一名「舉報人」5,000萬美元,創歷史記錄